do nonprofits pay taxes on utilities

Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing.

Call 211 Texas For Utility Assistance To Help You Pay The Light Bill

But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with.

. While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare just like any for-profit company. To be tax exempt most organizations. Licensed nonprofit orphanages adoption agencies and.

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. If I want to apply for tax exemptions in Arkansas where do I send my forms when I complete them. While nonprofits typically will not have to pay taxes they still have to submit annual tax returns with the IRS.

Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. Pepco collected nearly 546 million from customers to cover its income tax bill for the years 2002 through 2004. House Bill 582 which legislates the tax exemption.

Federal and Texas government entities are automatically exempt. Under current law charitable nonprofits in North Carolina pay sales and use tax on their purchases and can apply for semi-annual refunds of the taxes they pay. Most nonprofits do not have to pay federal or state income taxes.

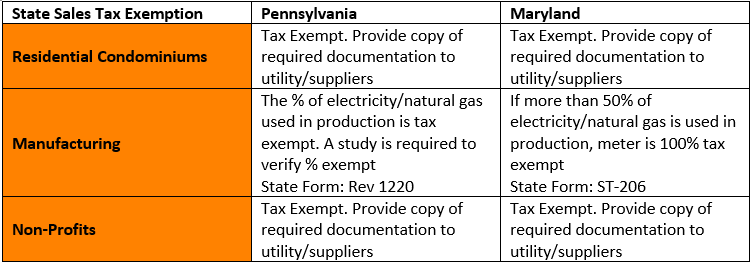

Florida law grants certain nonprofit organizations that meet the criteria described in Section 21208 7 Florida Statutes FS and certain state-chartered financial institutions described in. State sales tax exemption on utility bills Revenue Administrative ulletin 1995-3. Yes nonprofits must pay federal and state payroll taxes.

However here are some factors to consider when. Nonprofits and churches arent completely off of Uncle Sams hook. Do Nonprofits Pay Taxes.

Being tax exempt means an organization doesnt pay federal. Of Finance Admin. State and local property taxes state income tax and sales tax on purchases.

Your recognition as a 501 c 3 organization exempts you from federal income tax. As long as they already have incorporated nonprofit organizations often do not have to pay property taxes. Yet the parent Pepco Holdings did not pay income taxes during.

They must pay payroll tax all sales and use tax and unrelated business income. Although it varies by location many states counties and. Sales of utilities such as gas electricity telephone services telephone answering services and mobile.

Many nonprofit and religious organizations are exempt. Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas. The research to determine whether or not sales.

State tax exempt benefits vary by state but most include. New Sales-Tax Rules for Nonprofits. Taxes Nonprofits DO Pay.

Do nonprofit organizations have to pay taxes. Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals.

Limited exemptions from the payment of Georgias sales and use tax are available for qualifying nonprofit organizations including. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types.

However this corporate status does not automatically grant exemption from federal income tax. Corporation Income Tax Section PO Box 919 Little. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

So the first umbrella income.

Estes Sees Sales Tax Revenue Bounce Back In A Big Way Estes Park Trail Gazette

Solar Incentives In Utah Utah Energy Hub

Readablebest Of Sales Tax Worksheet Salestaxbycity Salestaxdecalculator Salestaxharyana Budgeting Worksheets Budget Spreadsheet Budget Spreadsheet Template

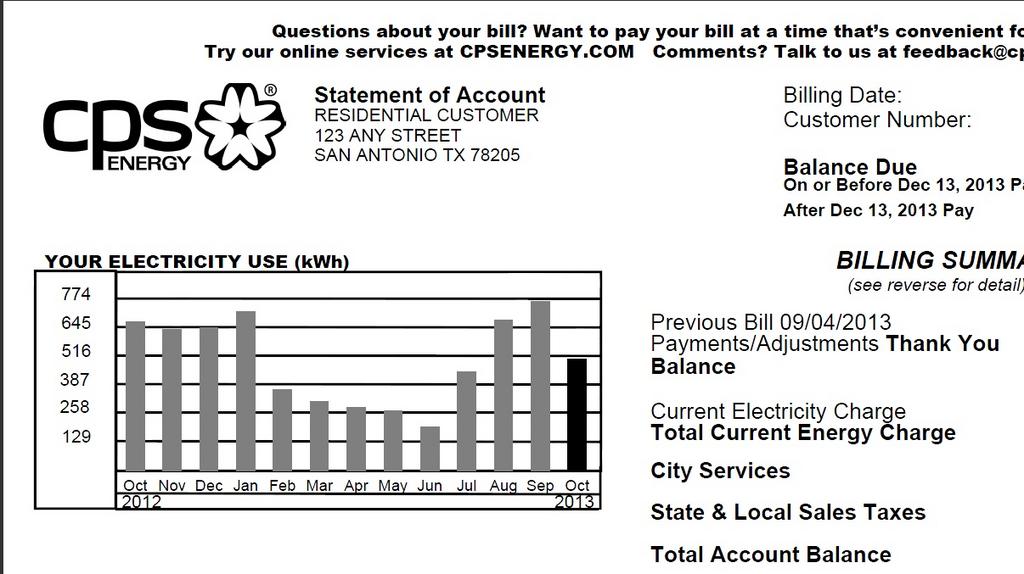

Bbb Fake Utility Bill Collection Scams On The Rise San Antonio Business Journal

City Manager S Proposed Fy2021 22 Budget Recommends Slight Decrease In Real Estate Tax Rate No Tax Increases Vbgov Com City Of Virginia Beach

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Budgeting

Tax Exemptions For Energy Nania

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Utility Users Tax Public Agency Accounts Spurr

Providing Essential Utility Services During Covid 19 Payments And Relief

Tax Exemptions For Energy Nania

Payment Kiosks For Utilities And Government Citybase

2021 Covid 19 Income Tax Deductions To Consider Qbix Nonprofit Accounting

Transportation Utility City Of Wisconsin Rapids

Nonprofit Project Budget Template Seven Doubts About Nonprofit Project Budget Template You S Budget Template Budgeting Worksheets Budgeting

Houston Utility Assistance Find Help To Pay Your Light Bill 2021

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Five Rules For Buying A House And How Far You Can Bend Them Buying A New Home Life Hacks Home Improvement